What are biometric palm payments: A guide for businesses

Cash, credit cards, and even smartphones are gradually losing their dominance in the evolving world of payments. The next frontier? Using the unique patterns of your palm to pay for groceries, coffee, or even a pair of shoes. Businesses around the world are already exploring and implementing biometric palm payments.

Adopting hand payment technology could transform your payment process and redefine how customers engage with your brand. Let's explore the potential of palm pay and learn how Keyo’s integrated hardware and software platform equips partners to adopt this technology quickly and securely.

What are palm payments?

Palm payments use biometric technology to enable individuals to pay for goods and services by scanning their palms. Instead of relying on cards, cash, or smartphones, specialized cameras quickly analyze the unique patterns of your hand. This includes two factors:

- Palm Print: Palm print scanning captures the intricate details of your palm's surface using advanced cameras. This process focuses on three critical layers contributing to a unique biometric signature:

- Primary Lines: The prominent lines are often associated with palm reading.

- Secondary Lines: Subtle lines visible to the naked eye.

- Epidermal Ridges: Delicate, fingerprint-like lines covering your entire palm.

- Palm Vein Patterns: With an advanced infrared camera, this technology maps the unique vein structure hidden within your palm, creating a highly secure and encrypted biometric ID. These vein patterns, invisible to the human eye, provide an unmatched level of security. Unlike external biometrics, your vein pattern remains completely hidden unless you actively choose to scan your palm, ensuring your unique biometric code stays protected from external exposure.

The combination of two identifiers generates a unique and secure signature linked to a user’s payment method. By utilizing both palm print and palm vein data, the technology is designed to scale seamlessly, accommodating tens of millions of users. Its growing popularity among businesses and consumers stems from its ability to streamline the checkout process while significantly reducing fraud.

Who can use palm payments?

Hand payments are for everyone. Businesses looking to offer faster, more secure, and customer-friendly payment options will find palm payments to be a step forward in gaining a competitive edge. From retail and hospitality to healthcare and entertainment, any industry dealing with payments can benefit from this approach.

Why is the hand the perfect, private identifier?

The human hand is uniquely suited for biometric identification for several reasons:

- Uniqueness: Each person’s palm veins and prints are entirely unique—even identical twins have different palm vein patterns.

- Unforgeable: Specialized cameras analyze millions of unique data points on the outside and inside of your hand. This dual-layer authentication ensures unparalleled security, making forgery virtually impossible.

- Contactless: Hand payments are contactless and hygienic, making them convenient in environments where minimizing touchpoints is essential.

- Private: Palm biometrics don’t leave a visible trace, unlike facial recognition, which uses publicly observable features. This ensures a higher level of privacy.

Together, these qualities make the palm a reliable and secure biometric identifier for payments. Discover why Keyo chose to center their platform around palm technology. Learn more here.

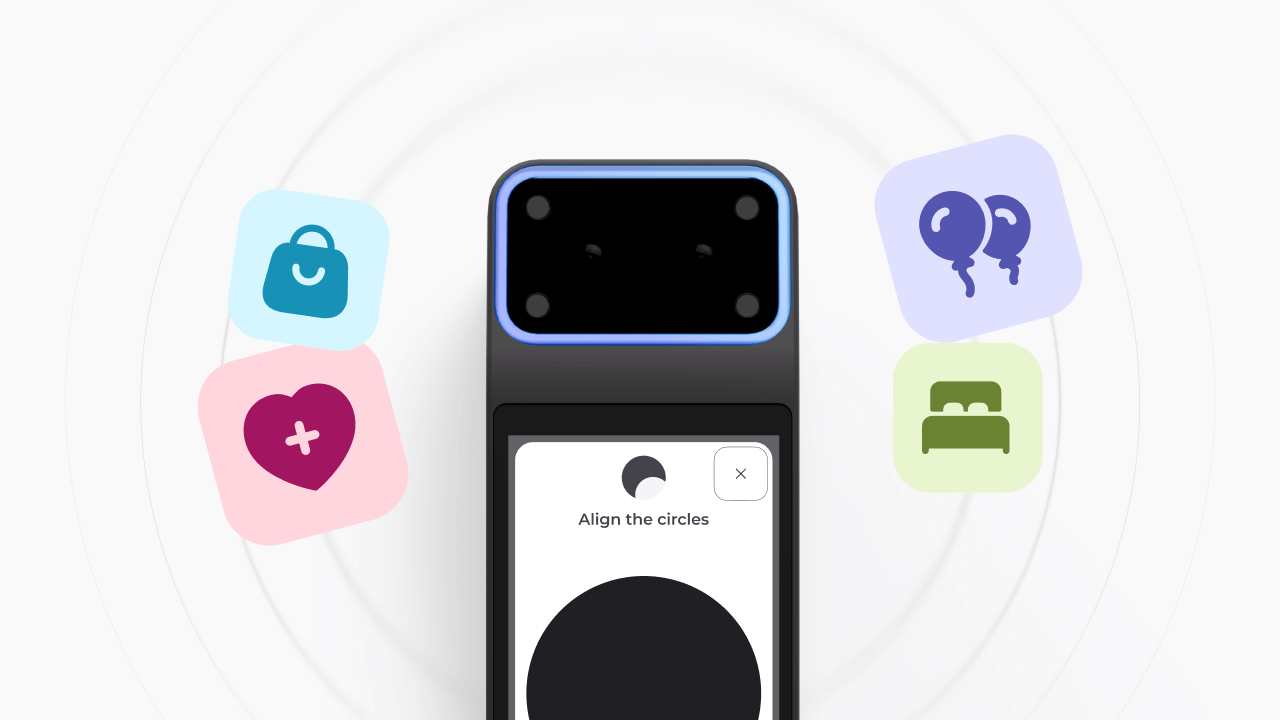

How Keyo makes it simple to get started with palm payments

Keyo is at the forefront of biometric palm payments, making it easier than ever for businesses to adopt this innovative technology. With its plug-and-play system, businesses can integrate palm payments without needing major overhauls to existing processes.

Here’s how Keyo simplifies implementation:

- All the tools businesses need: Keyo offers integrated hardware and software solutions designed for quick installation and easy configuration. With ready-to-use apps and APIs, partners can efficiently launch, develop, and test custom applications with minimal effort.

- Scalable: Whether you’re a small café or a global retail chain, Keyo’s security framework can scale seamlessly to fit your needs.

- Support: Keyo offers comprehensive training and customer support, ensuring a smooth onboarding experience.

Keyo is dedicated to making biometric transactions seamless, secure, and accessible for businesses of all sizes, worldwide. Learn more about Keyo’s product suite.

How does Keyo safeguard sensitive data?

At Keyo, we understand that not every business has the technical expertise or security know-how to implement biometric technology. That’s why we’ve created Keyo to be the ultimate “easy button” for seamless payments, check-in, and ID.

Security is the foundation of everything we do—it’s our expertise and highest priority. Our infrastructure was purpose-built with security at its core, allowing us to handle the complex details while you focus on delivering smarter, faster payment experiences. Here's why businesses and consumers alike rely on us to protect their sensitive data:

- Tokenization: Keyo never stores actual palm data. Instead, we convert it into encrypted tokens that are useless if intercepted. Users maintain full control over their biometric data, with the ability to delete it at any time or re-enroll their palm as needed.

- Compliance: Keyo adheres to the most rigorous global data protection standards, including GDPR, ensuring we meet and exceed regulatory requirements.

- Encryption: Every data transfer within Keyo’s systems is encrypted, adding an extra layer of protection against potential threats.

- Access controls: Sensitive data is shielded behind multiple layers of authentication, with access restricted to authorized personnel only.

What does this mean for our partners? It means you don’t have to be a security expert to integrate biometric payments into your business. Our system is engineered to handle every aspect of security, so you can set up payments quickly and effortlessly.

Whether you’re a startup or a large enterprise, Keyo’s robust security framework is designed to protect users, mitigate risks, and deliver a seamless payment solution.

Palm payments are expected to boom around the world

The rapid adoption of faster and more secure payment solutions is fueling significant growth in biometric payment systems worldwide. From small businesses to industry giants like Amazon, JP Morgan, and Mastercard, companies are embracing this innovative technology to enhance the payment experience.

Why now is the time to adopt:

- Rising customer expectations for seamless payment experiences.

- Increasing concerns about fraud and data security.

- A growing ecosystem of businesses ready to integrate biometric solutions.

Forward-thinking businesses that adopt palm payments today position themselves at the forefront of customer convenience and security.

Where are palm payments being used?

Palm payments are gaining popularity. Over the last five years, Keyo has deployed over 20,000 devices worldwide. Here are some common use cases we've encountered and can support.

- Retail: Major supermarkets and convenience chains are offering palm payments for a faster checkout.

- Cafes and restaurants: Coffee shops, restaurants, and grocery stores now use palm scans to allow quick, contactless payments.

- Healthcare: Hospitals and clinics are adopting biometric tech for secure patient identification and billing.

- Events and entertainment: Sports matches, concerts, and movie theaters are looking to incorporate palm payments to make transactions smooth and speedy.

- Hospitality: Hotels can allow their guests to navigate their property with a simple wave - no key cards, wallets, or IDs required.

This technology presents exciting opportunities to enhance both customer experience and operational efficiency across various industries. For businesses aiming to deliver memorable and distinctive customer interactions, implementing palm payments could serve as a game-changing differentiator.

Let's tackle some of the most common questions we receive.

As technology continues to expand, we recognize that businesses and consumers may have questions. Let's break down some of the most common questions we receive.

Is Keyo implanting a chip in your hand? Absolutely not! Keyo’s technology relies on advanced cameras that map millions of unique data points on your hand—no chips required.

What tools does Keyo offer to help you get started? Keyo equips its partners with both the hardware and software needed to implement biometric ID seamlessly. Out-of-the-box solutions are available for identity verification, check-ins, and time tracking. For payment integration, Keyo’s dedicated customer success team works closely with you to ensure a smooth and efficient setup.

What happens if my palm ID is hacked? Your palm ID is exceptionally secure due to its internal and external biometric mapping. It cannot be used without your consent. The technology captures millions of unique data points, converts them into a biometric ID, encrypts the information, and stores it securely. Additionally, you have full control—at any time, you can delete your biometric ID and generate a new one for added peace of mind.

How does Keyo collect biometric data? When members sign up for a Keyo account, they provide certain Biometric Data (two scans for each hand) at a Keyo device. Keyo collects that biometric data by converting it into a unique code, encrypting it, and storing it as an encrypted template on its data servers. This data is only accessible via Keyo devices, and the relevant encryption keys are only accessible to the Keyo devices and the Keyo ID Vault, making it impossible for a malicious user or even a Keyo employee to access the Data.

Join the future of biometric payments with Keyo

Biometric hand payments represent a significant step forward in how businesses and customers interact. With their unmatched security, convenience, and scalability, they offer game-changing possibilities for businesses across industries.

Now is the perfect time to join leading companies worldwide by adopting this growing technology. Keyo provides everything you need to get started, from hardware and software to training and support.

Learn more keyo.com