If you run branches, you know the hardest part of identity happens in the most ordinary moment: “Please show your ID.” We’ve built critical processes on a visual comparison that assumes a teller can reconcile a 10–15-year-old photo with a customer who has aged, changed hairstyles, grown a beard, or put on glasses, within seconds, under pressure. It’s an unfair standard for people and a fragile control for institutions.

The result is predictable: friction at the counter and exposure in your risk metrics. Every outdated ID becomes a judgment call. Ask for more proof and you slow the line; wave it through and you widen the fraud aperture. Across a day, those extra 30–60 seconds of scrutiny add up to fewer completed transactions, more abandoned queues, and a poorer customer experience while still leaving room for error.

Compounding the problem, appearances are increasingly unreliable. Faces are public, easy to capture, and now easy to synthesize. Palms are private. The subdermal vein pattern inside a hand is invisible to cameras and far harder to spoof, enabling presence-based verification tied to a live, consenting person—not a photo.

This post outlines a practical path to move from appearance-based identity to presence-based identity at the counter, reducing fraud, shortening lines, and giving your staff tools that match the responsibility you’ve given them.

The daily reality at financial institutions

What looks simple “check the ID” is anything but. Tellers face three simultaneous pressures:

Security: Is this the right person? If they’re wrong, fraud slips through.

Speed: Don’t hold up the line.

Service: Preserve dignity and trust in every interaction.

Every outdated ID is a security risk and a moment of friction.

For the teller, it’s a moment of stressful uncertainty. For the customer, it’s a moment of frustrating delay and potential embarrassment. Ask for a second form of ID and you risk damaging the relationship; accept a flimsy match and you increase exposure. We’re forcing human judgment to stand in for strong identity signals, and the cost shows up as fraud, false declines, slower lanes, and shaken confidence.

By the numbers: the cost of ambiguity.

Fraud isn’t niche, it’s systemic. Global card fraud losses exceed $30B each year and are projected to approach $50B by 2030 (widely cited Nilson Report projections).

The burden hits people, not just P&L. U.S. identity fraud impacts tens of millions of consumers annually and costs tens of billions in aggregate losses (Javelin Strategy & Research trendlines).

Fraud’s “true cost” multiplies. For financial services, every $1 of fraud typically costs $3–$4 after fees, write-offs, labor, and recovery (LexisNexis “True Cost of Fraud” benchmarks).

Manual ID checks slow lanes. Adding 30–60 seconds to a teller interaction during peak periods can cut effective capacity by a double-digit percent, forcing longer queues and more abandonments (time-and-motion branch ops benchmarks).

Faces are public. Palms are private.

We’ve also entered an age where appearances are easy to copy and hard to trust.

A person’s face is everywhere online. It can be photographed without consent, scraped, deepfaked, or used to generate fraudulent documents. A face is an appearance. By contrast, the palm’s unique subdermal vein pattern is internal and invisible to cameras. Modern palm-based systems map both the external palm print and the internal vein structure with liveness checks, tying identity to a living, consenting person—not to a picture that can be copied.

This shift—from appearance-based identity to presence-based identity—matters. Presence signals are far more complex to steal, share, or spoof. They reduce ambiguity for tellers and restore dignity for customers.

Make tellers the hero with better tools

If we want tellers to win, we have to change the game they’re playing:

Move from visual matching to biometric presence. Replace “Does this photo look like you?” with “Please present your palm.” The answer is clear, fast, and auditable.

Reduce cognitive load. Take the burden of forensic comparison off the human and put it onto a secure, repeatable system.

Protect privacy by design. Use biometrics that are internal and consent-driven, with liveness, encryption, and cancelable templates—so identity can be revoked and regenerated if needed.

Improve the experience. A quick, contactless gesture beats rummaging through wallets, explaining name changes, or debating whether a beard counts as “you.”

Operational reality check: why slow lines happen

A little math shows how “just a few seconds” becomes an all-day drag:

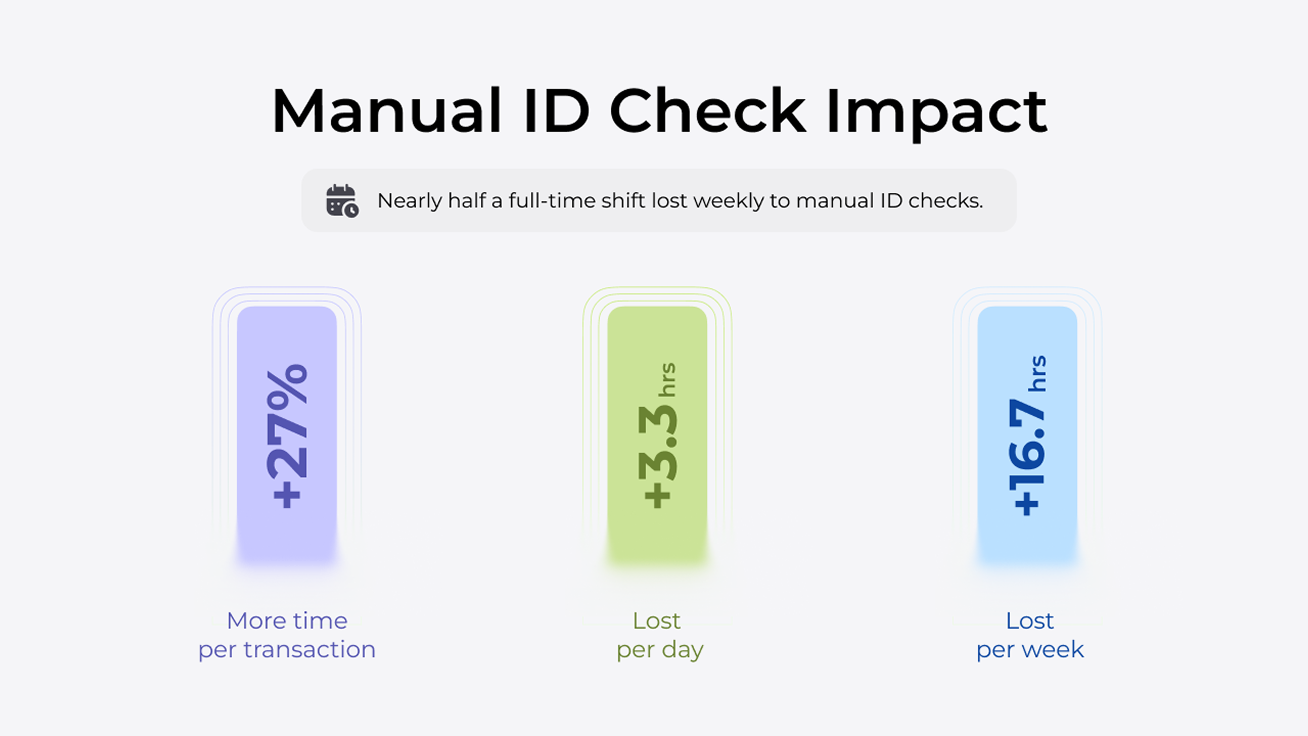

Per-transaction drag: If a typical teller interaction is ~2.5 minutes (150 seconds), adding 40 seconds for manual ID scrutiny is a ~27% increase in handle time.

Daily impact: At 300 transactions/day, that extra 40 seconds adds up to ~3.3 staff hours per day—time you pay for but customers experience as waiting.

Weekly impact: Over a standard 5-day week, that’s ~16.7 staff hours—nearly half a full-time shift spent on avoidable friction.

Replace ambiguous, manual ID checks with a fast, presence-based verification and you claw back those hours as shorter queues, steadier throughput, and a calmer branch floor.

What implementation looks like (without disruption)

Start where risk and friction are highest. Apply presence-based ID to transactions that drive the most losses or delays (e.g., high-value withdrawals, identity-change requests).

Layer, don’t rip-and-replace. Keep existing KYC/AML processes and add palm verification as the primary signal at the counter.

Train for trust. Equip tellers with a simple script: “For your security and speed, we use a private palm check that confirms you—not just your ID.”

Measure what matters. Track fraud reduction, false declines, average handle time, dispute rates, and NPS before/after. The business case is in the delta.

The payoff: security, speed, and dignity

When identity is anchored to presence, everyone wins:

For tellers: less guesswork, less stress, clear answers.

For customers: fewer awkward moments, faster service, stronger protection.

For the institution: reduced fraud and chargebacks, higher approval rates, cleaner audits, better loyalty.

We can’t ask people to solve a problem that tools make unsolvable. Tellers and agents have shouldered the ambiguity of identity for too long. Let’s make them the hero of a new story—one where the tools finally match the responsibility.

It’s time to retire appearance as our proxy for truth and adopt presence as our proof. In an age of deepfakes and copy-paste identities, that’s not just a technology upgrade, it’s a trust upgrade.

Ready to act without a rebuild?

Keyo fits the systems you already run. It connects through standard APIs to your core, teller platforms, card networks, and branch devices. Your KYC and AML controls stay intact. We add presence-based palm verification that lowers fraud and false declines and keeps lines moving.

Customers authenticate and pay with a simple wave. Their biometric remains private because it is internal to the hand, checked for liveness, encrypted end-to-end, and designed to be cancelable. Start with one high-risk flow where friction and losses are highest, measure the lift, and expand across your network at your pace.

For more information visit keyo.com or contact hello@keyo.co

5 benefits of palm vein biometrics for payments

5 benefits of palm vein biometrics for payments Biometric Authentication: How it works & why palm leads

Biometric Authentication: How it works & why palm leads